As part of our pledge to ensure that all of our clients are up to date with correct information, we want to notify you of how we are responding as a business and an industry to the impacts of the coronavirus.

Background information

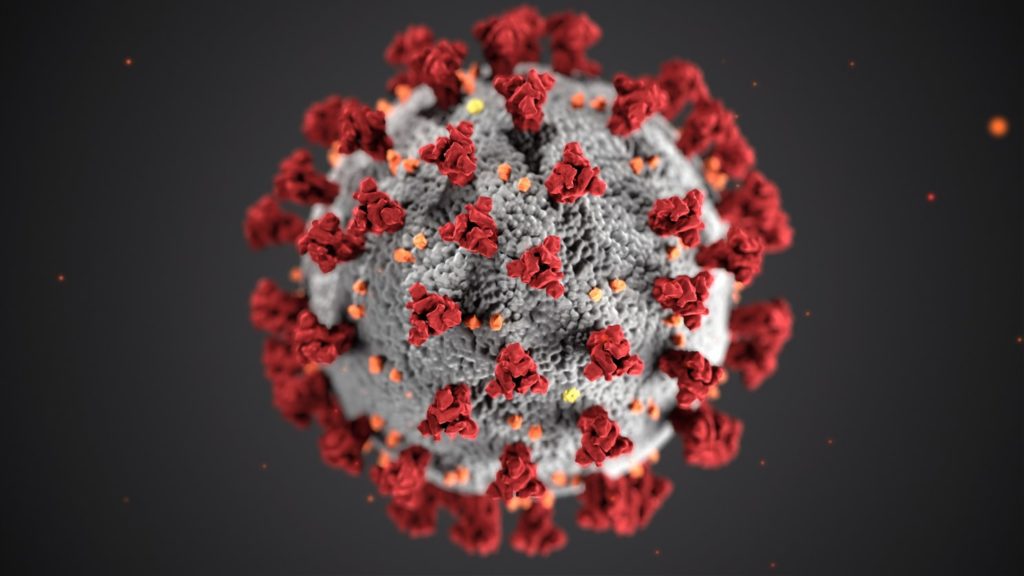

With over 118,000 cases in 114 countries, and at least 4,291 lives lost so far, fear and uncertainty continue to spread globally and throughout Australia. The Insurance Council of Australia has declared COVID-19 an insurance catastrophe and the World Health Organization has declared COVID-19 as a pandemic.

Until now, confirmed cases in Australia have been relatively small in number. However, the medical advice is that the Coronavirus will continue to transmit through the country.

What is Western General Insurance’s approach?

We remain committed to both serving our clients and communities AND prioritising the health and safety of our clients, employees, families, friends and neighbours. We would ask that if you’re feeling unwell (especially with known symptoms of COVID-19 such as fever, sore throat or cough) or been in contact with someone who may have contracted the virus, you do not attend our office but we are happy to shift any face to face meetings to phone or email. We will continue to operate ‘business as usual’ with preferred contact via phone or email. We’ve asked our team to refrain from attending the office if they’re feeling unwell and have increased our frequency of cleaning and sanitising common areas. Any future changes to our operations will be guided by our state and federal government. Thank you for your support and understanding.

How does the pandemic impact insurance?

We’ve had a few questions about this, so we’ve pulled together some facts from our industry resources to provide you with some insight and information.

Business interruption insurance

With COVID-19 disrupting many aspects of business and sales, insurance claims against policies offering business interruption coverage are set to soar. Whether the claims are covered or not will depend on the terms and conditions of the insurance policy and the circumstances of the loss.

Typically, some BI policies will respond to the closure of a business by an authority for a number of risks, including infectious diseases.

Whilst some specific policies may differ, in Australia the majority of business policies are likely to contain exclusions relating to losses caused by any disease notifiable under the Quarantine Act.

For clarification, you should check whether business interruption, caused by pandemics is covered under your specific policy.

Travel insurance

Most travel insurance policies have exclusions for outbreaks of pandemics. Many policies will also have restrictions that can be activated when the government endorses a ‘do not travel’ warning for certain locations. Policies purchased prior to coronavirus becoming a known event may cover travellers who are overseas for coronavirus-related expenses. This will depend on the travel insurance product purchased.

Travel insurance policies purchased after COVID-19 became a known event (between January 20-31, 2020) are unlikely to cover travellers who are overseas, or who are yet to travel for coronavirus-related expenses.

Life insurance

The Financial Services Council have recently stated that there are no exclusions in existing life insurance policies that would prevent the policy paying out for a death claim related to coronavirus. This is applicable for those who have followed Government travel advice. If you’re concerned, you should speak to your adviser about your specific situation and policy.

Business support and advice

Many businesses are feeling apprehensive about how the pandemic and people’s response to it will impact their sustainability. Being proactive about managing your risks now may save you headache or heartache down the line. On top of a strict regiment of hygienic measures and ‘social distancing’, now is the time to think about strategies to continue to operate your business and/or support the community. Can you reassure clients that you have taken additional safety measures? Can you expand your services to fit new requirements and expectations, such as delivery or virtual/video services? We’ve seen some savvy businesses ‘pivot’ into a slightly different niche, such as a catering company that lost a huge number of bookings and used their ingredients and chefs to prepare takeaway/delivery prepackaged meals. Some gyms and workout studios are offering live streaming classes instead of in person. How can your business look to meet the needs of your customers during this challenging time?

Luckily there could also be additional resources available to help you and your business survive. The Government has designed a response to support business investment, help small businesses manage short-term cash flow challenges, provide targeted support to individuals and assistance to the most severely affected communities and regions.

Below is more in depth information about the current support measures:

- Cash flow assistance for businesses

- Economic response to the coronavirus

- Delivering support for business investment

- Stimulus payment to households to support growth

Questions?

If you need any help or have questions about insurance please do not hesitate to contact us. Please take care of yourselves and look out for each other as we work together to get through this challenging time.